April 25, 2023 • 25 min read

.jpg)

Are you tired of spending countless hours screening new tenants only to end up with unreliable renters?

As a property manager or leasing agent, effective tenant screening is essential to finding the right fit for your rental properties. But with so many different factors to consider, navigating the process on your own can be overwhelming. That's why we've put together this comprehensive guide on tenant screening, including the step-by-step process, tools, and best practices.

By the end of this article, you'll be equipped with the knowledge and tools you need to confidently screen tenants and find the perfect fit for your property—without tearing your hair out or wasting your valuable time. Let's jump in!

What is Tenant Screening?

Tenant screening is the process of evaluating and verifying a prospective tenant's background and financial status to determine whether they will be a reliable renter. This process helps property managers and leasing agents assess the risk of renting to a particular tenant in order to make informed decisions on whether or not to approve their application.

The screening process generally involves:

- Having the prospective renter complete an application.

- Conducting a credit and background check.

- Verifying employment and income.

A robust screening process helps to identify renters who are likely to pay rent on time, take good care of the property, and be respectful neighbors.

Intellirent's Leasing Tools have helped property managers and leasing agents screen over half a million renters. We help leasing professionals thoroughly and legally screen tenants in the country's strictest, most tenant-friendly districts, including the Bay Area and Washington, DC. And our leadership team has over 25 years of combined leasing experience.

As experts in tenant screening, we've developed (through lots of trial and error) the ideal tenant screening process. In this article, we will share the exact steps to take to reliably screen renters, so you can avoid expensive problems.

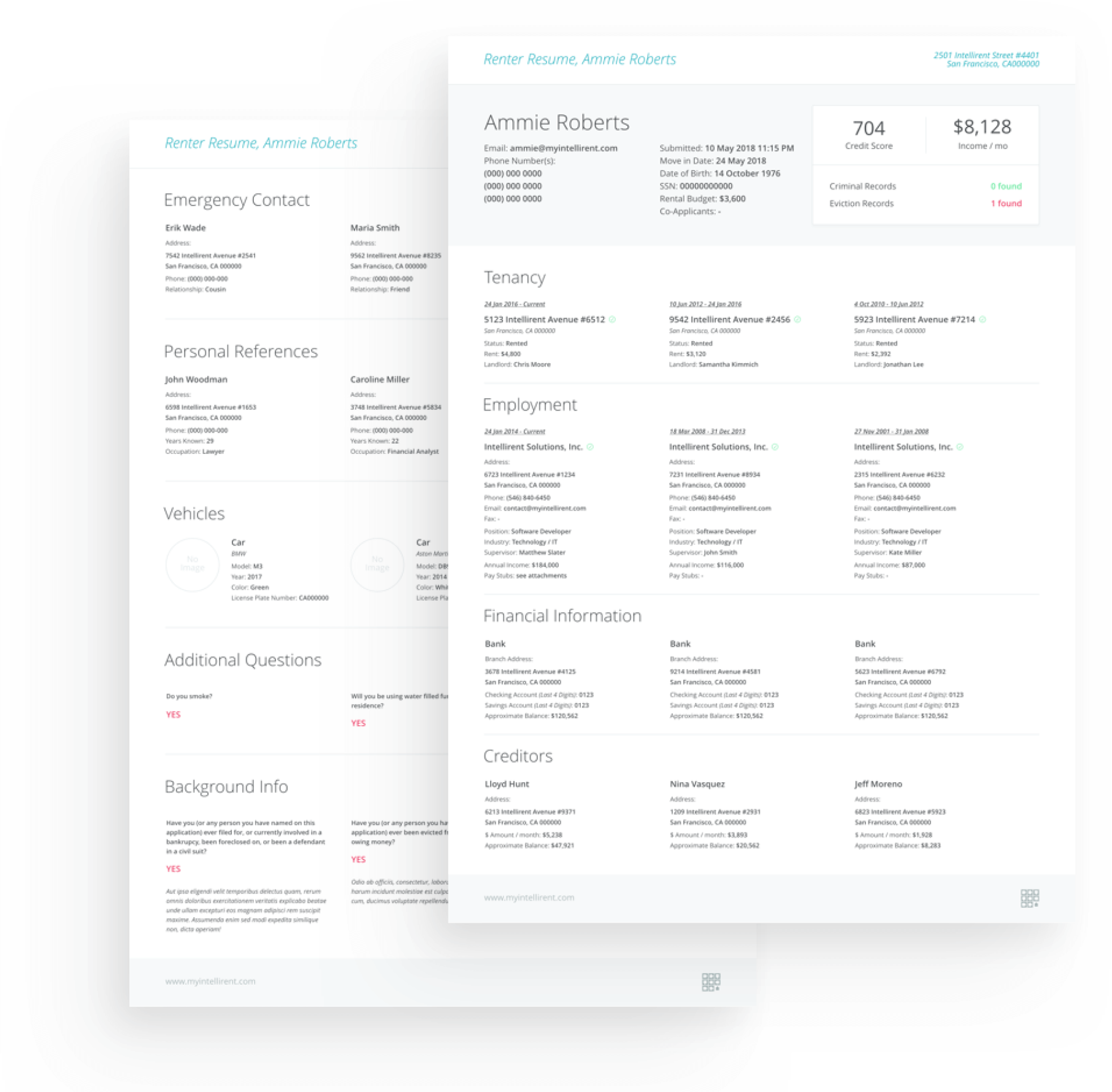

What is a Tenant Screening Report

A tenant screening report is a set of documents that lay out the prospective tenant's credit history, background, employment and income, and rental history. It highlights potential red flags, such as poor credit history, outstanding debts, eviction history, or criminal record.

Intellirent provides an easy-to-read Renter Resume™ that includes the application, reports, and all pertinent documentation in one convenient file.

Leasing professionals use the tenant screening report to assess the risk of renting to a particular tenant. By gathering all the information in one place, you can connect the dots to develop a clearer picture of the applicant and determine whether they are qualified to rent.

Why is Tenant Screening Important?

Tenant screening is essential in protecting the property, the neighbors, and your reputation as a property manager or leasing agent. Tenant screening helps to ensure you're renting to responsible, reliable tenants who will pay rent on time and take care of the property. It helps to reduce the liability associated with missed payments, property damage, evictions, squatters, and lawsuits.

Depending on your local laws, evicting a non-compliant renter or a squatter who refuses to leave can be extremely difficult. The costs of legal fees, court fees, lost rent, and property damage can quickly add up to thousands of dollars in losses and irreparable reputation damage for the agent who approved the renter.

What to Look for in a Rental Applicant: Green Flags

When reviewing rental applications, knowing what to look for is important. Green flags are signs to look for that indicate that a particular applicant is likely to be a reliable renter. Some of the most promising green flags include:

- A good credit report that shows consistent payments

- An excellent rental history and a glowing review when verifying with previous property owners

- The verified gross income is greater than 3x the rent

- The applicant is thorough, reliable, responsive, and timely. They're providing the right information promptly

- All the information provided is consistent and lines up

What to Look Out for in a Rental Applicant: Red Flags

Just as important as knowing what to look for is to know what to look out for. Red flags are indicators that you may have problems with a particular applicant. Certainly, there are no guarantees, but some red flags to watch out for include:

- A history of past eviction(s)

- A poor credit score and a credit report showing an ongoing pattern of missed payments or debts in collections

- Violent criminal background (Note: some localities prohibit property owners from making leasing decisions based on criminal background)

- The previous property owner states that the applicant frequently missed payments or created problems with the neighbors

- Applicants that are complaining, failing to follow instructions, or withholding information

- Applicants who are too eager, for example, they want to pay the entire year's rent upfront.

- Conflicting information: information provided on the application, such as income or background, doesn't match up with the reports and documentation

How Long Does Tenant Screening Take?

Many factors affect how long tenant screening takes, such as the technology used, how thoroughly the applicant completes their application, and how responsive past property owners and employers are in responding to verification requests.

Traditional leasing methods that use paper applications, manual data entry, and manual verifications can take four to ten days to complete tenant screening. And with traditional methods, agents spend an average of ten hours processing each application.

In contrast, leasing professionals who use Intellirent can screen applicants in as little as two hours, and most screenings are complete within one day.

A tool like Intellirent eliminates manual busywork from the process, so agents only have to review completed applications and make decisions, which cuts labor time down to less than one hour per application.

Tenant Screening Legal Requirements

Leasing professionals should consider several legal considerations when establishing or improving their renter screening process. Federal laws dictate how documents can be handled and what factors you can consider when selecting a renter. Additionally, many states and cities have local laws that further protect renters and limit what leasing professionals are allowed to do.

- The Fair Housing Act prohibits lessors from discriminating against potential renters based on race, color, religion, sex, national origin, familial status, or disability. Leasing professionals must treat all applicants equally and cannot use discriminatory screening criteria. Failure to comply with the Fair Housing Act can result in legal consequences, fines, and penalties.

- The Fair Credit Reporting Act requires landlords to obtain written consent from potential renters before running a credit check and to provide them with a copy of the report and information on their rights under the law. If you decide not to rent to an applicant based on information in a credit report, you must provide an adverse action notice.

- The Americans with Disabilities Act requires property owners to make reasonable accommodations for renters with disabilities, for example, allowing service animals and making necessary modifications to units. You cannot discriminate against renters with disabilities and must ensure that properties are accessible.

- The Federal Trade Commission Safeguards Rule requires leasing professionals to implement reasonable measures to protect the personal information they collect from unauthorized access, use, or disclosure. Keeping renter screening documentation and other private information confidential and secure is essential.

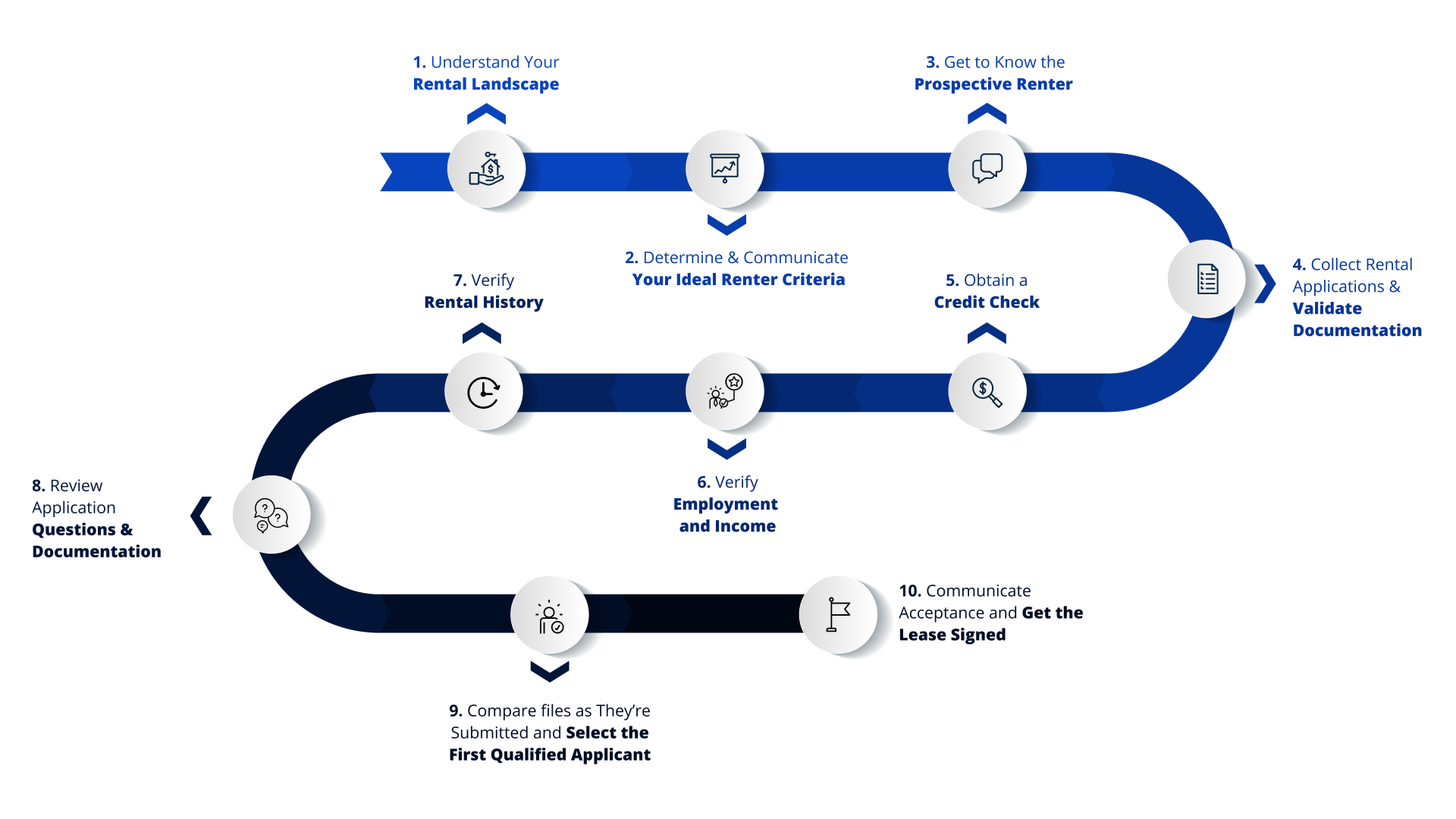

The Ultimate 10-Step Tenant Screening Process

- Understand Your Rental Landscape

- Determine & Communicate Your Ideal Renter Criteria

- Get to Know the Prospective Renter

- Collect Rental Applications & Validate Documentation

- Obtain a Credit Check

- Verify Employment & Income

- Verify Rental History

- Review Application Questions & Documentation

- Compare Files as They're Submitted and Select the First Qualified Applicant

- Communicate Acceptance and Get the Lease Signed

1. Understand Your Rental Landscape

The first step of your tenant screening process is to develop an understanding of your local rental landscape. It's essential to have a firm grasp of the market in which you're operating. You must understand the local laws that affect renter screening. Some local laws that may affect you include:

- Criminal Background: some localities prohibit property owners from using criminal background information when screening renters.

- Credit Information: certain cities restrict certain types of credit information from being used to qualify renters. For example, In Seattle, Washington, landlords cannot reject a renter based solely on their credit history.

- Application Fees: some local laws restrict how much property owners can charge for application fees. For example, California property owners can only charge up to $50 for an application.

- Number of Applications: some local laws restrict the number of rental applications a business can accept simultaneously. For example, in Portland, Oregon, property owners cannot accept more than one application for a vacant unit at a time.

In addition to local laws, it's important to understand and define your needs. What do you need to charge for rent to remain profitable? What qualities are important to find in a renter? Is it more important to fill a vacancy quickly or ensure you accept a highly-qualified renter?

2. Determine Your Ideal Renter Criteria

It's essential to define the minimum criteria for acceptance. The specific criteria will vary based on the unit's type, location, and rent. While the criteria you choose should be specific to your business's needs, some common factors include minimum income requirements, credit history, rental history, and pets.

Write down your ideal renter criteria so your team is clear on the expectations and so you can compare each application to the ideal criteria.

3. Get to Know the Prospective Renter

Getting to know each prospective renter helps to find a good fit for your property. When you meet with each applicant to tour properties, ask questions to help you gauge whether or not they are likely to qualify for the rental. Ask about the amount and source of income, rental and credit history, whether they have pets, whether the location is a good fit for their needs, and whatever else is important for you to know.

During this conversation, you should also clearly communicate your ideal renter criteria. Be transparent with your expectations for a renter. This open dialogue will help you get a sense of whether or not the applicant is likely to qualify for the unit. If it's unlikely that they will qualify, you can save both your and their time and prevent them from wasting money on an application.

It's also a good idea to explain the screening process. Help the applicant understand what to expect. Explain how you will collect the application, what documentation is required, how long it typically takes to process applications, and how you will approve the first qualified renter to complete the application.

4. Collect the Rental Application & Validate Documentation

Once the prospective renter has toured the property and expressed interest, it's time to start the screening process. Ask them to complete the application completely and honestly and provide all required documentation upfront.

One option is to use paper applications or PDFs. However, this outdated method is insecure and wastes your and the applicant's time.

Online applications keep data secure, make it easy for prospective renters to complete the application, and make it easier for you to review all the submitted information. Online applications also ensure all questions are answered, and necessary documentation is provided, preventing time-wasting back-and-forth with applicants.

It's also essential to validate that documentation appears genuine. Unfortunately, some prospective renters use Photoshop or other tools to generate or alter documents. It's important to catch this type of tampering, as it's a clear signal that this is not someone you should rent to. Intellirent has built-in tampering detecting, which uses AI to scan documents and flag potential falsifications.

5. Obtain a Credit Check

Obtaining a valid credit report is an important step in the screening process. Do not accept a credit report directly from the applicant, as these can easily be altered. Instead, receive consent from the applicant to run their credit, and then go directly to one of the bureaus to request a complete credit report.

Avoid services that provide only a credit score, as the score only tells a piece of the story. Instead, be sure to get a complete credit report to review payment history and any outstanding collections.

Intellirent integrates directly with Transunion to provide instant access to comprehensive credit and background checks.

6. Verify Employment & Income

Employment verification is a key piece of the renter screening process. This step involves calling the applicant's current employer and asking them open-ended questions, such as "will you please tell me about [Applicant's] employment status?".

Talking to the employer ensures that the applicant is genuinely employed and also helps you better gauge the applicant's character. If they're in poor standing with their job or their manager complains about their attitude or work ethic, they may not be the ideal renter for your property.

Income verification confirms that the reported income is accurate. This is typically done by reviewing submitted paystubs and comparing the total to the reported total.

7. Verify Rental History

Verifying rental history helps to confirm that the applicant has a positive track record of paying rent on time and taking care of their home. This step involves contacting previous property owners and asking questions about the applicant.

Past evictions may appear in background checks; however, recent policy changes have made it so courts cannot report certain information. Verifying directly from the source ensures that you get all the relevant information.

It's important to ask open-ended questions to get a feel for the applicant's character and history. For example, a previous property owner may not have evicted the renter but may have had problems with them that didn't result in eviction.

Some good questions to ask include:

- Did the renter consistently pay rent on time?

- Did you have any problems with the renter?

- Did the renter comply with the lease terms?

- What type of complaints, if any, did you get from neighbors or the community regarding this renter?

- How well did the renter take care of the property?

- Would you rent to this person again in the future?

8. Review Application Questions & Documentation

Now that you've collected the application, all necessary documentation, and completed the verifications, you're ready to gather all the information to evaluate whether the applicant will likely be a reliable renter.

This is the most critical step of the process, so don't rush it! Carefully read through the applicant's responses to application questions. Review the provided documentation, and read the credit report and payment history. Take the time to get to know the applicant, and be on the lookout for any red flags.

Check that all the data align. If you notice a discrepancy between what the applicant reported and what the documentation shows, it could indicate that the person is being dishonest. Although it could also be a mistake: feel free to ask the applicant to explain anything that seems off.

9. Compare and Determine the First Qualified Applicant

Compare each completed application against your ideal renter criteria. It's important to track when you receive each application because you are legally required to approve the first qualified applicant.

Intellirent timestamps every application, so it's easy to determine the order in which they were received. This protects agents from a renter claiming they were unfairly denied. If you have proof that someone submitted a qualified application before theirs, then the denied renter has no case.

10. Communicate Acceptance and Get the Lease Signed

Now comes the fun part. You've put in all the time and effort necessary to find a qualified renter for your property. Don't delay! Reach out immediately to communicate acceptance. The best renters will have no problem getting approved elsewhere– don't miss your chance to get them into your property.

The key is to have a system for rapid communication. Intellirent has built-in communication tools that enable agents to send a message the instant they determine that an applicant is qualified.

Generate and send the lease for digital signing as soon as you have a qualified renter. Getting the lease signed quickly prevents them from accepting a different offer. Intellirent's Leasing Tools pull in data from the application so that you can quickly generate a personalized lease.

It's also important to contact denied applicants to communicate the denial. In some localities, this is required by law, but regardless it's the right thing to do.

6 Tenant Screening Tips

1. Make Sure Files & Data are Handled & Stored Securely

Data security is essential for protecting applicants' personal information. Hackers are constantly getting more sophisticated and finding new ways to steal personal information. Because you're collecting personal data from applicants, you're legally required to protect that data from theft.

Be sure to use modern cybersecurity systems like firewalls to protect data. Avoid printing out personal information or collecting paper applications, as these can easily be stolen from offices or vehicles. You should also avoid sending protected data over email as it can be hacked.

Intellirent uses modern cybersecurity systems to protect all information collected and stored on our platform. By centralizing all personal data in one secure platform, you can ensure it stays out of hackers' hands.

2. Become a Member of Your Local Apartment Association

Joining your local apartment association is an excellent way to stay up to date on changes in your local community and network with other leasing professionals. Apartment associations are experts on local real estate laws and regulations. They provide members with invaluable tools, resources, and advice.

Some examples of apartment associations include:

- National Apartment Association (NAA)

- National Multifamily Housing Council (NMHC)

- Institute of Real Estate Management (IREM)

- National Association of Residential Property Managers (NARPM)

To find your local apartment association, ask other real estate professionals in your network or Google your location + apartment association.

Example: "San Antonio, Texas apartment association"

3. Don't Skip Screening Anyone

It can be tempting to skip screening. If the applicant seems like a good candidate, or if you know them personally, you may feel like screening is unnecessary. Don't fall into this trap! It's essential to screen every prospective renter, every time.

Even if someone seems trustworthy, it's important to verify by checking their background. You'd be surprised what shows up when screening people that seem great in person.

At the end of the day, this is a business. And, like any other business, it's essential to cover your assets.

4. Don't Take the Credit Score at Face Value

The credit score only tells you part of the story. Reading through the complete credit report gives you a clearer picture of whether the individual makes payments reliably.

Be on the lookout for missed payments, debts that have gone into collections, or bankruptcies.

5. Provide a Resource Toolkit

The best leasing professionals provide their renters with a resource toolkit that gives them everything they need to get established in their new homes.

Provide recommendations for renters insurance. Explain what is required to set up garbage removal, utilities, electricity, and internet service. Lay out any rules for the property, such as noise restrictions or pet policy.

6. Use Tenant Screening Software to Speed up Your Process

Tenant screening software like Intellirent expedites your leasing process. Save time by eliminating manual data entry and verifications, so that you can focus on reviewing completed applications and making intelligent decisions.

Leasing agents who switch to Intellirent save an average of forty hours of labor on each vacancy!

4 Tenant Screening Tools That Can Streamline Your Screening Process

1. Calendly

A tool like Calendly expedites the scheduling process for showings, tours, and appointments. You're able to easily share your availability with prospective renters and schedule appointments. This eliminates the need for lots of back-and-forth communication to set up appointments, allowing you to save time and streamline the scheduling process.

2. Secure File Management

As we've mentioned, keeping all applicant data and files secure is important. Using tools like Dropbox, DocuSign, or Google Cloud allows you to send and receive files securely. These tools eliminate the need for printing, mailing, and physically signing documents by enabling digital signing. They also prevent personal data from being shared via email, where it can be intercepted.

Dropbox and Docusign integrate natively with Intellirent, making it simple to use these tools within your Intellirent portal.

3. Email Automation

Setting up email automation like folders, labels, templates, and autoresponders can help keep you out of your inbox. Email is the great time-suck of the modern world. Taking the time to set up automation will save you time in the long run. Templates are a great way to draft messages quickly, and labels help organize your inbox.

4. Intellirent

Intellirent eliminates friction from your leasing process. Rather than wasting your time on manual data entry, exhausting back-and-forth with applicants, verification calls with previous property owners and employers, and digging through email to find files, you can centralize all documents, streamline communication, and eliminate manual busywork.

Intellirent also helps you automatically advertise your available units to fill your appointment calendar with eager prospects. Our modern, customizable online application is easy for applicants to complete. They must answer all required questions and submit documentation before they're allowed to submit the file.

If you're looking for a fast, secure, reliable tenant screening solution, Intellirent is here to help. Schedule a product tour to see exactly how Intellirent can help streamline your leasing process.

How Much Does Tenant Screening Cost?

Thorough tenant screening can cost anywhere from $45 to $200 per applicant. The cost of screening varies based on two major factors:

- The software or websites used to run the credit and background checks

- The labor costs associated with employees processing applications

Some companies only consider the cost of running the reports; however, if you're not considering labor costs in this calculation, you may be severely underestimating how much you're spending on screening prospective renters.

Let's illustrate the point with an example.

The Cost of a Traditional Screening Process

The traditional screening process is fraught with manual busywork. First, you send applicants a PDF application. They fill out part of it and return it. You send it back and ask them to complete all the questions. Once returned, you take their application and manually enter the relevant information into a form on one of the credit bureaus' websites. Then you send the applicant another email to ask for documentation.

Next, you call the previous property owners. After several phone calls and voicemails, you get in touch with them. Then, you call the applicant's employer, who is out of the office, but they promise they will return your call the following day. After a few days of not hearing back, you call and complete the verification.

Now you're ready to review the complete application. You dig through email and file folders to find the application, the documentation, and the verification information. You gather everything together, review the provided information, and determine whether or not to approve the applicant.

Costs:

- Credit and background reports: $20

- 10 hours of labor at $15 per hour: $150

- Total cost: $170 per applicant

The Cost of the Intellirent Screening Process

Leasing professionals who use Intellirent automate away all the mundane busywork.

First, you send your applicant the link for your customized online application. They answer all the required questions and attach all documentation to submit the application. The moment they do, the software goes to work generating a comprehensive credit and background report, which is available in minutes. We also send verification requests and follow up as needed to deliver completed verifications, typically within one day.

Once the Renter Resume™ is complete, you simply spend a few minutes reviewing the responses to the application questions, documentation, and reports to determine whether the applicant is qualified.

Costs:

- Intellirent application fee: $30 (paid by the applicant)

- 1 hour of labor at $15 per hour: $15

- Total cost: $45 per applicant

Many companies choose to pass the cost of the screening onto the applicant by charging an application fee. Keep in mind that some locations have restrictions on how much leasing professionals can charge for a rental application. Be sure to follow all local laws and regulations.

Additionally, agents must do their due diligence and screen all adult applicants, so each applicant should complete an application.

Accelerate Your Tenant Screening Process

You're now equipped with all the knowledge you need to reliably and effectively screen tenants. Keep in mind that investments made in tenant screening pay off in reduced vacancy rates, increased on-time rent payments, and improved communities. Skipping or skimping on renter screening can have disastrous consequences on your reputation and business.

Following a robust tenant screening process may seem like more work, but it's 100% worth it. And with a tool like Intellirent, you get the best of both worlds! You don't have to choose between fast, effective, or easy– with Intellirent's Leasing Tools, you get all three!

Intellirent empowers leasing professionals to eliminate friction in their leasing process. No more manual busywork; instead, agents who use Intellirent spend their time showing properties, talking to prospective renters, and reviewing completed applications.

Finally, there's a tenant screening tool built by leasing professionals for leasing professionals. Schedule your personalized product tour today to see how Intellirent can save you time, money, and frustration by streamlining your leasing process.

Published by Cassandra Joachim

April 25, 2023

Related Articles

May 09, 2023 • 7 min read

March 30, 2023 • 10 min read

Subscribe For Insights

Get actionable leasing tips, tools, and best practices directly to your inbox. Don't miss out on the insights that'll help your team confidently find, screen, and approve the most qualified renters.